When visiting Europe, you’ll find that many goods and services are assessed a “value added tax,” or VAT. It’s a tax on consumption rather than income, and it ranges from 15 to 25 percent. If you pay this tax when shopping abroad, you can often get your money back after you’ve returned home, since travelers are typically entitled to a refund for the VAT portion of prices for goods. But getting that refund can be a headache. Here are 10 things you need to know about claiming VAT refunds.

Image Gallery

Refunds from Goods, Not Services

Countries generally exempt exports from VAT. So when you buy merchandise or other goods as a tourist, what you take home is considered an export. Accordingly, you are entitled to a refund for the VAT portion of the price.

On the other hand, when you stay in a hotel or eat a restaurant meal, those services are consumed locally rather than exported. Accordingly, tourists are not entitled to VAT refunds on those purchases. Some business travelers are allowed to recover VAT on services, but the process is so complicated that only large corporations with heavy business travel ever try to recover it.

Refunds from Goods, Not Services

Countries generally exempt exports from VAT. So when you buy merchandise or other goods as a tourist, what you take home is considered an export. Accordingly, you are entitled to a refund for the VAT portion of the price.

On the other hand, when you stay in a hotel or eat a restaurant meal, those services are consumed locally rather than exported. Accordingly, tourists are not entitled to VAT refunds on those purchases. Some business travelers are allowed to recover VAT on services, but the process is so complicated that only large corporations with heavy business travel ever try to recover it.

VAT Can Be Big

VAT is the English-language term; other terms include IVA, TVA, moms, MwST, and a handful of unique local terms. EU (much of Western Europe) rules require that member countries impose a VAT of at least 15 percent; most rates are in the range of 19 percent to 25 percent. Many countries exempt some purchases entirely or apply reduced percentages on "essential" purchases such as food, rent, transportation, and medical services. A few countries also exempt certain regions from VAT or apply reduced rates because of quasi-independent status or to encourage economic development. Among Europe's reduced- or no-VAT areas are the Aegean Islands, the Azores, the Canary Islands, and the Channel Islands.

VAT rates in Europe's four non-EU countries are 25.5 percent in Iceland, 25 percent in Norway, 8 percent in Switzerland, and 18 percent in Turkey, again with some exempted or reduced rates. Check here for rates in all European countries.

Keep in mind that the VAT rate is the amount added to a pretax base price, not a percentage of the final price. Thus, a 20 percent VAT rate amounts to 16.7 percent of the purchase price.

It's Included in the Price

As a practical matter, merchandise prices you see in stores almost always include VAT. So do posted hotel rates and restaurant prices. The general rule is that what you see is what you pay. Online travel agencies (OTAs) usually post hotel prices inclusive of VAT—but not always, so check the fine print! Also, some localities impose the equivalent of sales taxes, in addition to VAT, on hotel accommodations, but they do not include these in the posted price; these additional taxes are usually quite low.

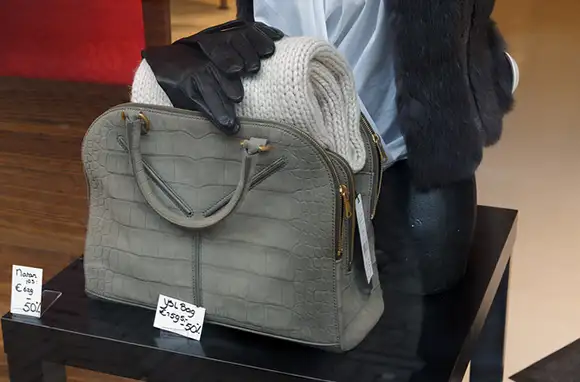

Your Goods Must Leave the Country

Most European countries allow you to recover VAT when you "export" an item. But you must prove that the goods actually left the taxing authority before collecting your refund. (For countries in the European Union, this means you must leave the EU, not just cross an internal EU border.) If you leave by plane, you have to show the goods after you pass through the customs formalities.

To qualify for a refund, the goods must be new and unused. If you buy some high-fashion accessories in Paris, for example, you shouldn't use them until you leave the EU.

There Are Minimum Qualifying Amounts

Many countries establish a minimum price per item or daily value per store to qualify for a VAT refund. This minimum ranges from zero in Ireland, Germany, and the U.K. to CHF 300 (about $333 USD according to XE.com) in Switzerland, €175 (about $237) in France, €155 (about $210) in Italy, €125 (about $169) in Belgium, and €90 (about $122) in Spain. Check here for detailed rates throughout the EU.

Where to Buy

Buy from stores that handle VAT-refund paperwork. Most stores that do this post a "Tax Free" or similar sign somewhere on a door or window; big department stores often have special VAT offices. On the other hand, street vendors, sidewalk artists, many small-town stores, and such generally don't provide this service, so you're out of luck when you buy from them.

When you buy, have the merchant provide the necessary paperwork, sometimes called a "cheque," and complete the paperwork before you leave the store. (You'll probably have to prove that you're from outside the country or VAT area.)

When you leave the EU or the country in which you bought the items, take the merchandise and the paperwork to the border station and have the documents stamped by a local customs agent. Typically, the agent will ask to see the items, so don't pack them in checked baggage—or, at least, be able to check bags after you've cleared customs. This is critical: You won't get the refund without the stamp.

Work with Your Merchant

The easiest way to get a refund is to have the merchant handle it at the point of sale. Some merchants ask you to sign two credit card chits: one for the pre-VAT price and another for the VAT. You still have to do the paperwork and have it stamped, but when you clear the checkpoint, you just mail the completed paperwork to the merchant to prove that you really took the goods out of the area. When the merchant gets the paperwork, he or she tears up the credit card slip for the VAT. Alternatively, you sign one chit for the full price and the merchant later refunds the VAT to your card.

You can also avoid VAT by having a merchant ship the goods to you directly at your home address. In most cases, however, this isn't a good solution. Shipping charges can be very high, and you have to pay U.S. duty, even if you haven't used up your import allowance.

Let the Pros Do It

Two agencies specialize in facilitating VAT refunds. Typically, you want to shop at stores that participate in one of these agencies' programs; this will be displayed on a sign. Go through the purchase and customs paperwork, as described. Then, after passing through customs and getting your paperwork stamped, find an agency office to process the refund. The big agencies maintain refund desks in the departure areas of major international-gateway airport terminals, at some ship and ferry terminals, and at some downtown offices. Typically, you have a choice of getting a cash, check, or credit card refund. These outfits generally deduct as much as 30 percent of the refund amount as a fee for services.

Global Blue is the largest; it operates throughout Western Europe, as well as in several Eastern European countries, Argentina, Japan, Morocco, Singapore, South Korea, Turkey, and Uruguay. Premier TaxFree operates in a limited number of European countries but covers Jordan. Check the agencies' websites for more details.

Buy at Tax-Free Airport Stores

You can avoid paying VAT by waiting to buy in a "tax-free" airport store, usually located after the departure formalities at major international airports. The post-customs areas of many big European airports are now more like upscale shopping malls than airports. But store prices at most airports are pegged to be just a little below local "high street" VAT-inclusive prices, not at the local price minus the VAT. Those fat markups help fund the airport.

Beware of the Gotchas

As noted, the paperwork and the customs stamp are critical to the process. Unfortunately, you can sometimes miss out on the chance to comply. One way to miss out is to buy from a supplier who doesn't do the paperwork. Independent artists, street merchants, and many other sellers don't participate in the programs and don't provide paperwork.

You can also miss getting the paperwork if you cross an unattended border. These days, you can pass out of a tax zone without encountering any customs office or official at all—for example, when you drive a rented car or take a train or bus through a lightly used border crossing. If you fly home from Geneva but return a rented car on the French side of Geneva International Airport, you'll find that the customs kiosks in the corridor between the French and Swiss lobbies of the terminal building are generally unattended by either country.

Some countries have work-arounds for these problems. Check the agency websites for details, preferably before you encounter a problem.

You Might Also Like:

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Related

Top Fares From

Today's Top Travel Deals

Brought to you by ShermansTravel

Shop and Save with Country Inns...

Patricia Magaña

Hotel & Lodging Deals

Hotel & Lodging Deals

$229 -- Chicago: Discounted Rates and...

Francesca Miele

Hotel & Lodging Deals

$229+

Hotel & Lodging Deals

$229+

$188 -- Honolulu: Save on Oceanview...

Abigail Lamay

Hotel & Lodging Deals

$188+

Hotel & Lodging Deals

$188+