The first real action to prevent hotels from posting false low-ball prices on initial rate searches, also known as hidden “resort fees,” is finally underway. The Attorney General of the District of Columbia asked the D.C. Superior Court for injunctive relief against Marriott (the world’s largest hotel chain) for violations of the District’s consumer protections against deceptive advertising. And it could mean a lot for the future of hotel pricing.

Specifically, the lawsuit asks the court to require that Marriott post up-front rates, including any mandatory fees retained by hotels, in its own postings as well as data submitted to online travel agencies (OTA) such as Booking.com, Expedia, etc. The suit also calls for civil penalties, lawyers’ fees, and restitution. The current suit is limited to Marriott, with restitution limited to D.C. residents, but further action against Marriott and other hotel chains and in other jurisdictions seems likely.

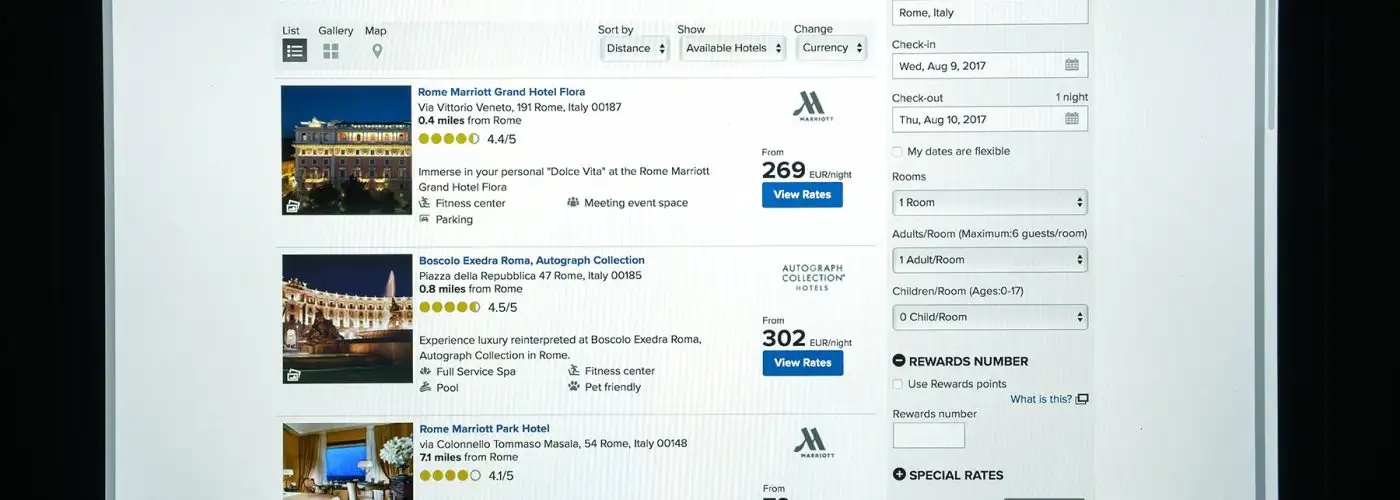

How to Spot Hidden Resort Fees

This suit is in response to the growing trend of hotels (not just Marriott) splitting total room rates into two components: a false, low-ball price designed to achieve a favorable placement in rate searches, and a mandatory “resort” or other fee that hotel guests must pay separately, after they’ve chosen the low-ball price. Originally confined to resorts in a few major tourist destinations, most notably Hawaii and Nevada, the practice has spread to many vacation destinations and hotels, and lately to city hotels under names such as “facility” or “destination” fee. Although hotels cook up laundry lists of services the fees are claimed to cover, the fact that the fee is mandatory means such excuses are meaningless: If you’re required to pay it and the hotel keeps it, it’s part of the overall price.

The current suit does not hold that mandatory fees, as such, are inherently illegal; in fact, many stakeholders agree that they are not, if adequately disclosed. The crux of the issue is whether current practice—disclosure downstream in the purchase process—is adequate. The District suit claims that it is not; that the only way to avoid consumer deception is to include all mandatory fees in the original price postings that consumers use to narrow hotel searches.

The District’s position has precedent: The Department of Transportation says it’s OK for airlines to split a total fare into base fare and carrier-imposed fee categories so long as the figure presented to consumers in the original fare search includes all fees. Some airlines do this; others don’t, but either way, fare comparison searches honestly reflect what travelers will pay to fly.

Hidden fee price advertising is, in the term used by the Federal Trade Commission (FTC), “per se” deceptive. Still, in making few and feeble gestures to it, the FTC has punted on the issue. So it falls to states to enforce their own truth-in-advertising requirements.

What the Resort Fees Lawsuit Means

The District of Columbia becomes the first state-level entity to take on the deception by tagging the lead in going after a major hotel company. Although this suit was not filed as part of a group effort through the National Association of Attorneys General (NAAG), it’s highly likely that similar suits against Marriott and other giant hotel chains in other jurisdictions will be forthcoming in the next few weeks and months. The suit raises three intriguing questions:

- Will other state-level attorneys general file comparable suits against Marriott or other giant chains? If so, how soon?

- If the initial suits are successful, how long will the hotels try to delay implementation through appeals?

- How will booking sites respond—will they somehow differentiate between Marriott’s prices and other hotels’ or will they post all-up prices across the board?

For consumers, the ideal outcome would be voluntary agreement by the hotel industry to abandon the practice of adding mandatory fees. Although that sounds delusional, it happened in Florida: When the state required cruise lines to stop stripping part of the price out and calling it “port charges,” the cruise industry decided to clean its act up nationally and phony port charges disappeared entirely.

Absent hotel industry cooperation, the OTAs could also, on their own, provide the option of all-in price postings. In fact, the OTAs could go a step beyond, by including local taxes in the initial postings, as well. There’s no question as to whether such postings are feasible; OTAs already post all-inclusive rental car rates.

Clearly, this move is just the beginning of the story. Stay tuned for more updates.

More from SmarterTravel:

- When to Book a Hotel Room for the Best Price

- The 12 Most-Hated Travel Fees and How to Avoid Them

- After 20 Years, Action on Hotel Resort Fees May Finally Be Imminent

Consumer advocate Ed Perkins has been writing about travel for more than three decades. The founding editor of the Consumer Reports Travel Letter, he continues to inform travelers and fight consumer abuse every day at SmarterTravel.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Related

Top Fares From

Today's Top Travel Deals

Brought to you by ShermansTravel

Shop and Save with Country Inns...

Patricia Magaña

Hotel & Lodging Deals

Hotel & Lodging Deals

$229 -- Chicago: Discounted Rates and...

Francesca Miele

Hotel & Lodging Deals

$229+

Hotel & Lodging Deals

$229+

$188 -- Honolulu: Save on Oceanview...

Abigail Lamay

Hotel & Lodging Deals

$188+

Hotel & Lodging Deals

$188+