Hurricane season starts June 1 and runs through November 30, with a peak activity period from late August through September. So if you’re considering taking advantage of shoulder-season resorts or cruise deals in the Caribbean this year, you’d be smart to keep the forecast for hurricane season 2019 in mind and weigh the risk versus the reward—plus travel insurance.

Here’s what travelers need to know.

The Hurricane Season Forecast

Overall, two recent hurricane forecasts for the 2019 season conclude that this year is likely to show activity close to the average hurricane season, which typically has close to the same number of extreme weather occurrences we saw in 2018. A study by Colorado State University predicts 10 to 16 named storms (winds of 39 mph or higher); three to seven hurricanes (winds of 74 mph or higher); and one to three major hurricanes (winds of 111 mph or higher). AccuWeather predicts 12 to 14 storms, five to seven hurricanes, and two to four major hurricanes.

Higher-Risk Destinations

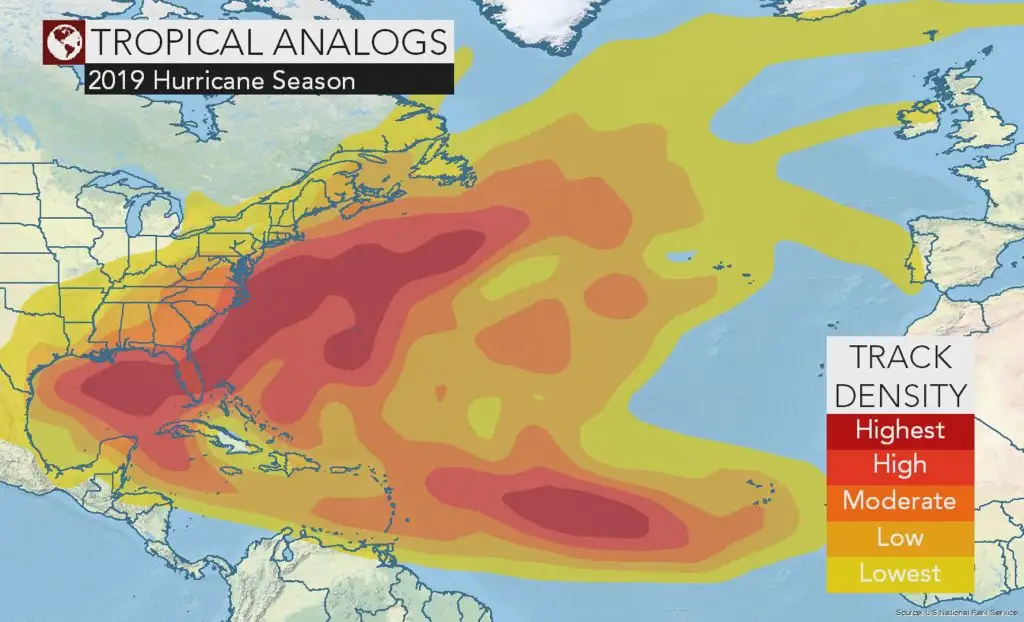

According to AccuWeather’s map, areas in the U.S. in the “high” and “highest” risk categories run from the New Orleans area along the Gulf Coast, around and across the entire state of Florida, and up the Atlantic Coast as far North as Delaware. Riskiest areas in the Caribbean and nearby include western Cuba, the northern Bahamas, and the northern tip of Yucatan. According to the same map, the low risk areas include much of Hispaniola, the Leeward Caribbean Islands, and the Leeward Antilles from Aruba to Trinidad. For more recommendations, see The 5 Best Beach Vacations During Hurricane Season.

A Disclaimer

Even though 2019 is likely to be statistically close to average, nobody has a clue as to just how likely or when one of those half-dozen hurricanes could turn into “the big one.” Even in a supposedly low-risk hurricane season, no one knows when an rare but extreme weather situation could occur. They often do without any warning.

The Insurance

If you’re considering a cruise or resort holiday to an at-risk area that requires substantial down payments (read: cancellation penalties), trip-cancellation insurance (TCI) can protect you. But you have to make sure any policy specifically lists “hurricanes” as a “covered reason” for kicking in the benefits. Or, get a policy that includes a “cancel for any reason” option.

For full protection, buy the insurance early, within a week or two of the time you make your first payment, for two reasons. First, on many policies, early purchase waives exclusions for pre-existing medical conditions. Second, you have to buy before a specific hurricane has been predicted or named.

You’ll get the best protection if you buy from an independent travel insurance agency (not the add-on insurance that come as an add-on fee with bookings) such as Squaremouth or QuoteWright. For more information, see How to Buy Hurricane Travel Insurance.

More from SmarterTravel:

- Travel Insurance Coverage: 17 Things Your Policy Won’t Cover

- How to Avoid Caribbean Hurricane Season

- Hurricanes and Travel: What Your Options Are When One Hits

Consumer advocate Ed Perkins has been writing about travel for more than three decades. The founding editor of the Consumer Reports Travel Letter, he continues to inform travelers and fight consumer abuse every day at SmarterTravel.

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Related

Top Fares From

Today's Top Travel Deals

Brought to you by ShermansTravel

Shop and Save with Country Inns...

Patricia Magaña

Hotel & Lodging Deals

Hotel & Lodging Deals

$229 -- Chicago: Discounted Rates and...

Francesca Miele

Hotel & Lodging Deals

$229+

Hotel & Lodging Deals

$229+

$188 -- Honolulu: Save on Oceanview...

Abigail Lamay

Hotel & Lodging Deals

$188+

Hotel & Lodging Deals

$188+